Award-winning

Automated program trading educates businesses

Won the world award of program trading for 4 consecutive years.

The Best Algorithmic Trading Enterprise

Forex Forest Algorithmic Trading

Forex Forest focuses on automated program trading education and program software development, and is one of the few companies in Asia that specializes in developing enterprise-level AI trading programs and teaching automated program trading. It is committed to promoting and educating automated trading and applying it to the mass trading market. With its excellent and leading technology, the automated trading program developed by Forex Forest has won numerous awards and is loved by the general public.

Our advantage

Algorithmic trading

✓ The trading program supports more than 4000+ brokers worldwide

✓ Can be used in a variety of trading markets, including Forex, Indices, Gold, Silver, Cryptocurrencies and other popular trading commodities

✓ Time-saving, computer program 24 hours automatic trading

✓ Achieve consistent, stable passive income

Professional teaching

✓ Courses are ISO9001 certified

✓ Clear and high-quality program trading instructional content

✓ Up to 10 years of AI trading experience taught by the team personally

Enterprise-class program benefits

✓ The technical team develops its own trading program

✓ The program has won the Global Trading Award for 4 consecutive years

✓ Have the strongest trading program to practice AI trading

Easily understand the trading infrastructure

✓ Own GEMSFX teaching system integrates course and tool resources

✓ Seamless integration of teaching courses with third-party trading systems makes it easy to practice procedural trading

Why Program Trading?

Programmatic trading system is the world’s emerging trading method in the past 20 years, using technical analysis or statistical mathematical measurement methods to find a profitable model, according to the instructions generated by this model, buying, selling and entering and exiting, this trading mode is called programmatic trading, can also be called “quantitative trading” (Quantitative Trading).

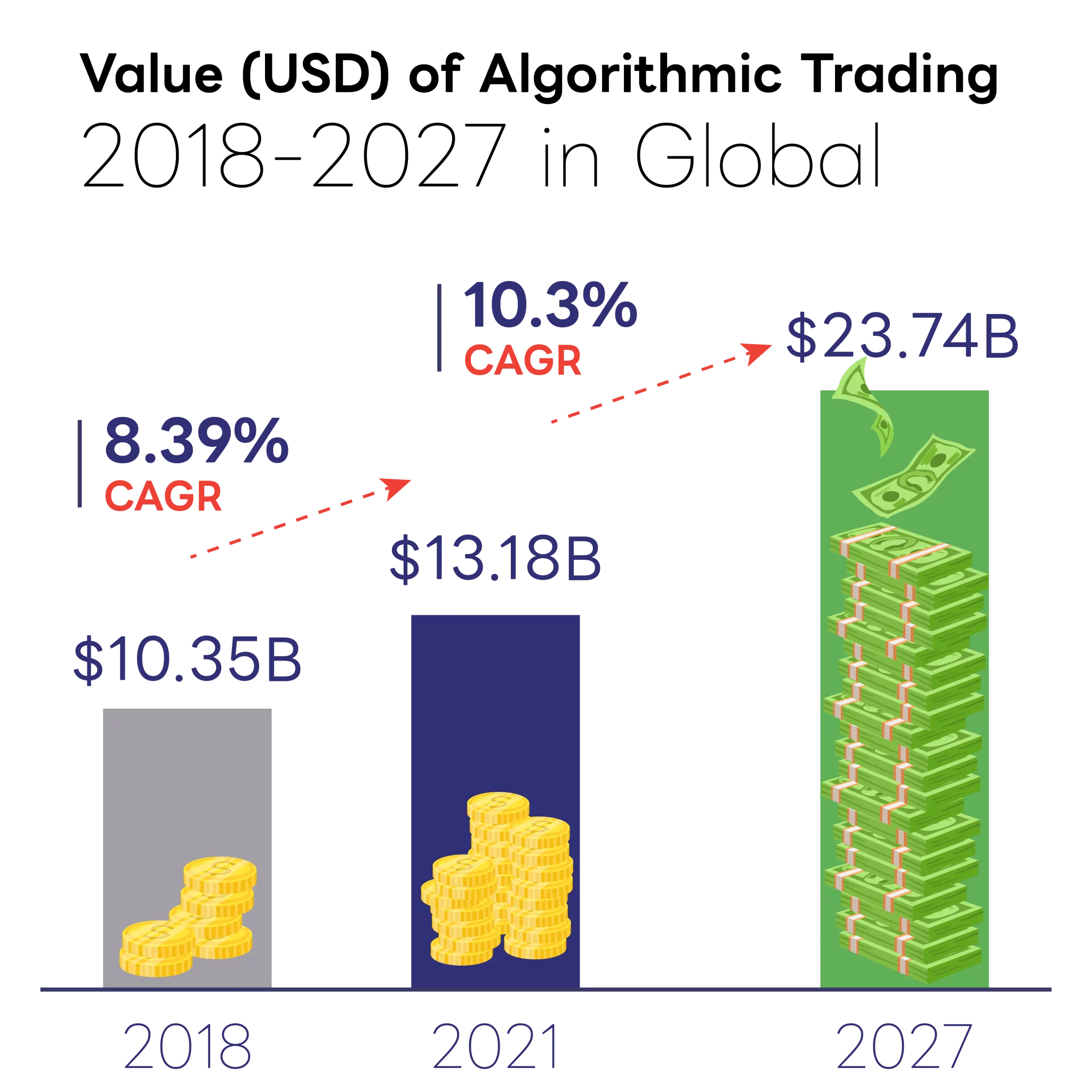

The global algorithmic trading market (below is the market study) was worth $10.35 billion in 2018. It increased to USD 13.18 billion in 2021 in three years. The market is expected to reach $23.74 billion by 2027, growing at a CAGR of 10.3%.

Algorithmic trading has gradually become a new trend in market trading, and the share of quantitative trading in US stocks has shown a long-term continuous upward trend, accounting for about 60-73% of the overall stock trading in the United States (Wall Street survey). Foreign futures funds even have completely automated program trading as the main entry and exit basis, and their excellent performance is on the list.